2.3 Homes as investments

Especially in countries like the UK, a home is viewed as a solid and desirable investment. But is this belief well-founded?

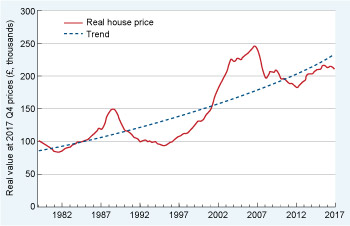

Figure 4 shows the change in real house prices in the UK over a long period (1979−2017). The prices are shown in real terms, in today’s (2017) money. For example, in 1979, the actual (nominal) average UK house price was only £22,000 but prices of goods and services then were much lower, so that was a lot of money. It would be equivalent to £101,000 today, which is the real value in today’s (2017) prices shown in Figure 4.

Figure 4 shows that, despite some ups and downs, the trend in real house prices has been upwards over the whole period. Based on that trend, the rise over the 38-year period has been 169%. That seems a lot, but in fact it’s an average of only 2.6% a year – hardly exceptional for an investment.

However, most homeowners have made a lot more than a real return of 2.6% a year from owning their home. What has made residential property so profitable for them is that property is usually bought with a mortgage, making it a leveraged investment. You’ll look at what that means now.