4.2 Balance sheet ratios

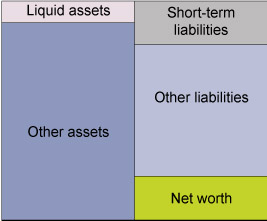

As Figure 13 illustrates, assets can be divided into two broad categories, liquid assets and other assets (that is, those that are less liquid). Liabilities can also be divided into short-term liabilities, typically debt for which repayment is due within one year, and other liabilities, with longer repayment horizon.

This distinction is made in order to derive three important ‘ratios’ that can tell us something about a household’s financial situation:

- Net worth: Subtracting the household’s total liabilities from its assets gives the measure called the household’s net worth. Net worth is the amount of money the household would be left with if all its debts were paid off.

- Current asset ratio: This is an indicator of the liquidity position of the household, in other words, the scope for raising cash to pay off all its short-term debts. This depends on the extent to which the household has at least some assets that have high liquidity. The higher the current asset ratio, the better is the household’s liquidity situation. If the current asset ratio is less than 1 (that is, short-term liabilities exceed short-term assets), the household would already have a liquidity problem if it wanted to – or had to – clear its short-term liabilities in a hurry (as might be prudent in the event of redundancy or prolonged illness). There’s no hard and fast rule, but personal finance experts generally recommend that a good target to aim for is a current asset ratio of 3 or 4.

- Leverage ratio: This gives a measure of the household’s overall level of indebtedness, expressing total liabilities as a proportion of total assets. It sheds light on two aspects of the household’s finances. Firstly, is the household solvent (could it meet all its debts if it had to)? A leverage ratio above 100% indicates that a household’s debts exceed all its assets and so technically the household is insolvent. Secondly, it suggests how resilient the household might be if conditions changed – for example, a household with a high leverage ratio could find its spending rising sharply if interest rates were to rise. This could make servicing its debts (keeping up the repayments) difficult or impossible. A low leverage ratio may indicate a comfortable level of solvency and resilience, but that doesn’t mean that keeping it low is always a household’s most rewarding financial strategy. A relatively high leverage ratio can be beneficial for a household if it borrows to buy assets (or to improve assets like human capital) which then rise in value. But this strategy also carries risks if the assets don’t perform as expected.