4.1 Income and assets

Before examining housing and the balance sheet further, it is important to be certain about the difference between income and wealth:

- Income is a flow of money received over a period of time, such as a salary every month, weekly rent from a property, annual interest from savings, or a weekly cash benefit for children. Notice that a flow of money is always associated with a time period.

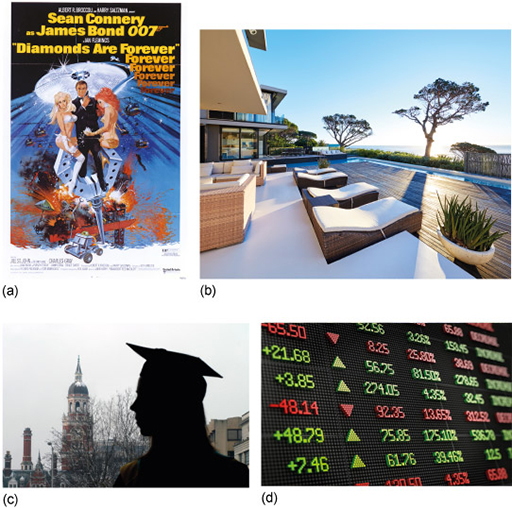

- Assets (also called wealth) are stocks of resources, valued at a point in time. They may have been accumulated over time as a result of saving (setting aside some income) or transferred between people at a point in time (for example through inheritance). A house, a car, the balance in a bank or building society account, investments, personal possessions, a piece of the London 2012 Olympic Cauldron or a Modigliani sculpture are all assets.

There are three main types of asset:

- Financial assets: for example, money in a savings account, shares in a company, investments you have in your pension fund. These often produce a stream of income (in the form of, say, interest on savings or dividends from shares).

- Physical assets: for example, objects of art and jewellery, cars, land or property. Physical assets usually have to be sold to be transformed into cash, but property is one obvious exception because it can produce income – a rent – without being sold.

- Intangible assets: for example, rights to eventually receive a state pension, insurance policies that may pay out on a future date or event, and your ‘human capital’ (the value of your skills, experience and education that allows you to sell your labour in exchange for earnings). Copyrights in artistic and intellectual creation and patents for inventions are other examples of intangible assets.

One important aspect in thinking about assets is their ‘liquidity’: the easier it is to turn an asset into cash without losing any value, the more liquid an asset is said to be.

Activity 11 Distinguishing income and assets

- Select which of the following items are income and which of them are assets by placing a tick in the appropriate column.

- Looking at the items you identified as assets in question 1, can you say which are more liquid and which less liquid?

Discussion

Liquid assets are those that are most easily converted to cash without losing value, while less liquid assets are not so easily converted to cash and/or whose value can change quickly.

The most liquid asset is the instant-access savings account, while the least liquid would be the house and the artwork.

Shares are usually treated as less liquid, since, in most cases, when traded on stock exchanges, they can easily be converted to cash. However, their value can fluctuate rapidly.

- Can you think of a reason why a household may have a large value of assets and yet may not be as financially secure as first appears?

Discussion

Households also have liabilities, that is, money they owe for example to banks or credit card companies, other people and to firms whose services they have used but not yet paid for, and taxes owed but not yet paid. The difference between a household’s assets and its liabilities is crucial to understanding the financial strength of a household.