3.1 Different types of mortgage

A mortgage is a type of loan used to buy property. It is a ‘secured’ loan, meaning that it is backed by the property being purchased. This means that, if at any time during the mortgage term you do not make the remaining agreed loan payments, the lender can seize and sell the property to get its money back. In that event, the lender will often go for a quick sale, so the sale price may be less than the full market value of the property. This means that, once the loan has been repaid, the amount (if any) left for the former homeowner may be low.

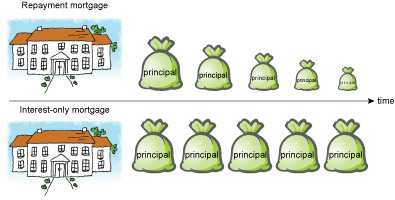

There are two basic types of mortgage: repayment and interest-only. ‘Interest’ refers to the main charge for borrowing money, normally calculated and expressed as a percentage of the amount owed.

Repayment mortgage

With a repayment mortgage, the ‘principal’ (the original sum borrowed, also called the ‘capital’) is paid off through regular monthly payments made throughout the life of the loan, along with the interest. The key feature of this type of mortgage is that, provided all the monthly repayments, are made, the amount owed is reduced to zero by the end of the mortgage term, so the former borrower then owns their home outright.

The typical structure of a repayment mortgage is a ‘reducing balance loan’. The payments are set at the same amount each month, calculated to be the exact amount needed to reduce the loan to zero by the end of the term. (If the mortgage’s interest rate changes, the level of monthly payments is recalculated and set to a new level to ensure the loan is still completely paid off by the end of the term.)

Each monthly payment is made up of both interest and repayment of a bit of the principal. Initially the payments are mainly interest. One consequence of this is that a borrower who wishes to repay the mortgage in the early years might be surprised at how much of the principal remains. But the amount of principal repaid each month accelerates over the term of the mortgage.

Interest-only mortgage

With an interest-only mortgage, the monthly payments during the term comprise just the interest on the loan. There are no repayments of the principal sum during the term of the loan.

The principal is paid off only at the end of the loan in a single lump sum. It’s essential that the borrower then has the means to repay the principal. Failure to do this means the property may be repossessed. One way to plan for repayment of the principal is to pay money regularly throughout the life of the mortgage into a savings or investment scheme. To determine how much to save each month, the investment is projected to grow at an assumed rate in order to produce a lump sum large enough to repay the principal in full at the end of the mortgage term. Usually, there is no guarantee, so the homeowner runs the risk of having to adjust the amount they save each month or having to find money from elsewhere to pay off the rump of the mortgage if the savings or investment plan falls short of the full amount needed.

Another option would be to plan to sell the property when the mortgage ends. That’s suitable for someone who has bought a second home or a property they rent out, but would leave an owner-occupier with the problem of where to live.