1 Introducing inequality

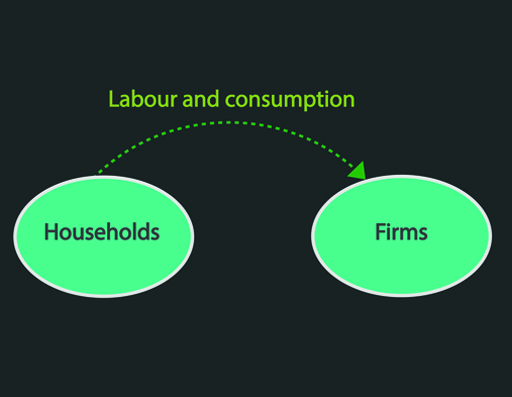

As a starting point for the discussion of inequality, consider the workings of a simple economy shown in Figure 1.

In an economy, firms use labour performed by households to produce goods and services. This is a flow of resources from households to firms as shown by the green arrow in Figure 1. Economic resources are also transferred from households to firms as consumption spending of the former on goods produced by the latter.

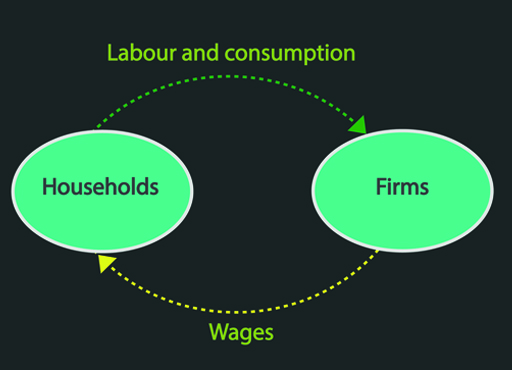

In return for this flow of labour and consumption from households to firms there is a corresponding flow of income from firms to households, as shown by the yellow arrow in Figure 2. This income takes the form of wages.

Activity 1 Circular flows of income

Figure 2 looks at the flow of labour and wages around a simple economy. What other inputs might be used by firms to produce goods and services in an economy?

Answer

As well as labour, firms also use other economic resources, or inputs, such as land and capital. Land includes not only land itself but all natural resources such as minerals and forests. In order to produce an output firms will also need to use machinery, factories etc. These are man-made resources and are referred to as capital. Owners of these inputs receive capital income in the form of interest, profits and rents. Land and capital may be owned by households but might also be financed by other agents in the economy such as banks.

Figures 1 and 2 portray a very simple model of the economy in that they only include two sectors of the economy: households and firms.

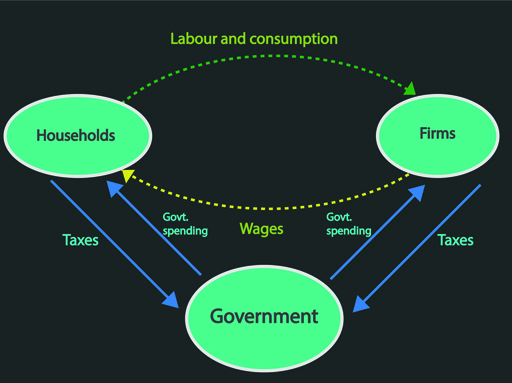

Can you think of another sector inside an economy which might be included in the circular flow diagram to make this a more realistic model of the economy? What additional flows would this new sector generate?

Answer

To make our model of the economy more realistic a government sector could be included. Like households, the government spends money on goods and services. This results in an income flow from the government to firms and households. As well as spending, the government also collects resources in the form of taxes. As both households and firms pay taxes this results in flows of income from both households and firms to the government.

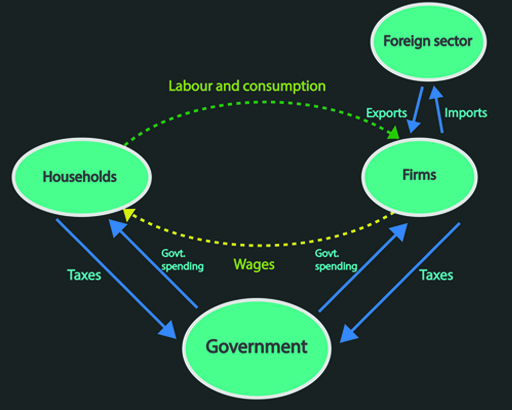

Households, firms and government are all part of a domestic economy. The circular flow diagram can also represent the relationship between income in the domestic economy and rest of the world. How would you introduce the foreign sector into the diagram?

Answer

A second sector that can be introduced into the circular flow diagram to make it a more representative model of the economy is a foreign sector. The income flows discussed so far take place within our simple economy but income flows may also take place between economies. Some of the income that households earn is spent, not on goods and services from domestic firms, but rather from firms located overseas. This leads to an income flow from domestic households out of the economy to overseas firms. Similarly, the goods and services that firms produce domestically may be bought by overseas households, resulting in a flow of income from overseas households to domestic firms.

Although Figure 4 represents only a very simple model of the economy it is a useful starting point for a discussion on economic inequality.

a.

The distribution of income of an economy between households and firms.

b.

The distribution of income in an economy within the household sector.

c.

The distribution of income between countries.

The correct answers are a, b and c.

Answer

The circular flow diagram helps you identify several sources of income inequality in the economy: how income of an economy is distributed between firms and households; whether some households benefit more from wages and salaries than others; and comparison of one economy with other economies in the world: thinking of the whole world as one global economy, does one country receive more of total global income than other countries?

Last but not least, the circular flow diagram shows an important economic agent which has a role in addressing income inequalities: the government. You will look at how government mitigates inequality in the last section of this course.