3.2 Sources of income

The picture of inequality also depends on what kind of income is taken into account. Recall from Activity 1 that households earn labour income from employment and capital income from owning assets. Business owners also receive capital income in the form of profits. Such sources of income which are received directly by a person for performing a given economic activity is called original income.

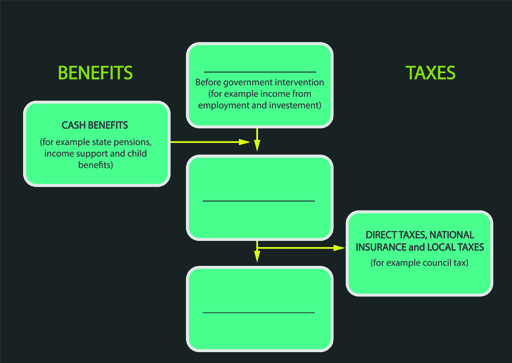

In Figure 3 you also saw that another importance source of income for households comes from government. Some households will receive cash benefits from the government such as pensions, child benefit, etc. Adding this to original income gives the total amount of income a household has to spend and is termed gross income.

After receiving income from these sources households will need to spend some of their money on taxes. These include direct taxes such as income tax, council tax and national insurance. Income that is left for expenditure and saving once taxes have been paid is called disposable income. This amount is generally more representative of the standard of living than their original income as it determines the amount of income available to buy goods and services.

Activity 5 Measuring income

Work out the correct labels missing from this diagram for each source of income.

Answer

Here is the completed diagram.

Data on income are collected by directly asking households about it in surveys, or from government tax returns.

Imagine you are asked the following question in a household survey: What is your monthly income?

Do you think that this would be a straightforward question to answer, and why?

Answer

On the face of it this is a seemingly easy question but in practice it may not be as easy as it looks. The answer to this is becoming increasingly difficult as working patterns change and many people don’t work the same hours every month. Someone on a zero-hour contract might experience a very varying monthly income. In addition to this the information on capital income might require time to put together. Individuals earning very high incomes might be reluctant to disclose their income to household surveys. Generally information about incomes may be seen as sensitive with people being reluctant to share the information. You would also need to include any benefits received. These are often underreported.

An alternative source of income data is information obtained from the HMRC via tax returns. Can you see any problems there might be with using this data as a source of information on incomes?

Answer

Collecting information on income from taxes also has some drawbacks. Individuals on very low incomes who are below the tax threshold would not be recorded in this system. Additionally not all income will be declared to the HMRC. Again, as with household surveys, there may also be issues with confidentiality when using HMRC data.