4.2.1 How income is shared between labour and capital

The total income generated in an economy is known as national income. Polish economist Michal Kalecki (1954) describes how national income can be split into income earned by labour and income earned by the owners of capital, or capitalists. This is the same as saying that the total income in the economy is split between wages, or labour income, earned by workers and capital income from profits earned by capitalists.

The share of national income going to labour and capital can vary over time and it is this variation which many argue has been a contributory factor to changing levels of income inequality.

Households may earn income from both labour and capital. But it is labour that is the predominant source of income for households, constituting an average of 70% of total household income in the UK (Department of Work and Pensions 2018).

Activity 11 Inequality between labour and capital

Complete the national income equation below by filling in the boxes with the different types of income described by Kalecki.

Once you have filled in the national income equation correctly, drag and drop the panels below to assign economic agents which are the main recipients of each respective type of income.

Using the following two lists, match each numbered item with the correct letter.

-

Whole economy

-

Workers

-

Capitalists

a.Wages/labour income

b.National income

c.Capital income/profits

- 1 = b

- 2 = a

- 3 = c

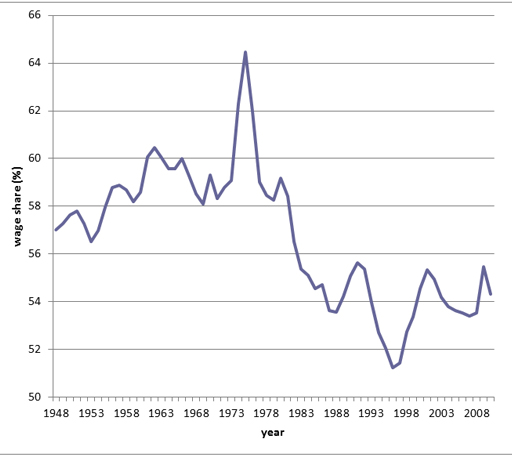

Figure 17 shows how the wage share as a percentage of national income has fluctuated since 1948.

Briefly describe the trend in the share of wages between the mid-1950s and 1980.

Answer

The graph shows that from the mid 1950s to 1980 the share of wages in national income was largely between 59% and 61%. The exception to this was a peak in the mid 1970s when the wage share reached over 64%. Since this peak the wage share steadily declined, remaining below 56% over the next 30 years with a lowest point below 52% during the second half of the 1990s.

Listen to an extract from an interview with Duncan Weldon, former senior economist at the Trade Unions Congress, an organisation representing UK trade unions. Answer the questions below to explore the causes and changes in inequality between labour and capital in recent years.

Transcript: Audio 1

According to the interview, what have been the main changes in the wage level in the UK and how wage income is shared among all workers in the economy?

Discussion

In the lead-up to the 2008 recession wages didn’t grow for the low and middle part of the earnings ladder despite 11% of economic growth. Wages for this group have been stagnating since 2003, but already since the 1980s median wages have been failing to keep up with productivity. In the interview, wages are described as being frozen, that is there has been very little wage growth, even before the recession. In particular, wages have not been keeping up with changes in productivity. The increased productivity enables more output to be produced which generates more income. However, much of the income that this extra output has generated since the 1980s, has not been passed on to labour but instead has been paid to capital. References are made in the interview to wages, particularly at the middle and bottom of the income distribution, stagnating at the expense of increased profits. The interviewed worker explains that his firm is making profits yet he has not seen a wage increase in 4 years.

What are the two main reasons give in the discussion for the fall in the share of wages in total income?

Discussion

The first reason given in the discussion to explain the fall in the wage share is changing technology. The advancement of technology has resulted in more skilled jobs. At the same time, however, lower skilled jobs have been lost as many of them have been replaced by automation. The same number of employees is therefore chasing fewer lower skilled jobs. This put downward pressure on wages in this sector of the labour market. As there are relatively fewer jobs for the same number of workers it is the employers who saw see a strengthening of their bargaining position, being able to extract more profit.

The second reason given in the discussion is globalisation. While productivity has increased in manufacturing, wages have not increased. The interview describes how the increase in globalisation has meant that there has been an increase in competition for jobs from workers in other countries. In particular, production of the manufacturing sector has in large parts shifted overseas. Many manufacturing processes are outsourced to countries where there are low wages. This again puts downward pressure on wages in the domestic market.

What other reason relating to the relationship between workers and employers are discussed in the interview to explain the fall of the wage share?

Discussion

As explained in the interview another reason often given by economists for the falling share of wages in total income is the reduction in the power of trade unions. During the 1980s several acts were passed which reduced the power of trade unions. In 2017 approximately 6.2m employees were union members. This is a sharp contrast to the 13m employees who were union members in 1979 (ONS 2018). This again reduces the worker’s bargaining power and so produces a downward pressure on wages.

A final explanation given for the falling wage share in total income discussed in the interview is the change in corporate behaviour, coinciding with the deregulation of financial markets, which has taken place since the 1980s. In the interview it is argued that there has been an increased emphasis on shareholder value, which boosted profits of firm owners. This happened because a larger share of corporate profits was redistributed to shareholders rather than reinvested in workers, which lowered wages relative to profits.