1 Technological change, demand and costs

The new economy

Over the past 40 years global computing power has increased a billionfold. Number-crunching tasks that once took a week can now be done in seconds. Today a Ford Taurus car contains more computing power than the multimillion-dollar mainframe computers used in the Apollo space programme. Cheaper processing allows computers to be used for more and more purposes. In 1985, it cost Ford $60,000 each time it crashed a car into a wall to find out what would happen in an accident. Now a collision can be simulated by computer for around $100. BP Amoco uses 3D seismic-exploration technology to prospect for oil, cutting the cost of finding oil from nearly $10 a barrel in 1991 to only $1 today …

Thanks to rapidly falling prices, computers and the Internet are being adopted more quickly than previous general-purpose technologies, such as steam and electricity. It took more than a century after its invention before steam became the dominant source of power in Britain. Electricity achieved a 50% share of the power used by America's manufacturing industry 90 years after the discovery of electromagnetic induction, and 40 years after the first power station was built. By contrast, half of all Americans already use a personal computer, 50 years after the invention of computers and only 30 years after the microprocessor was invented. The Internet is approaching 50% penetration in America 30 years after it was invented and only seven years since it was launched commercially in 1993.

(The Economist, 23 September 2000, pp. 5, 10)

That is how The Economist discussed the issue of information technology as a general purpose technology.

Question

How would you summarise the argument about prices, costs and information technology put forward in The Economist?

Discussion

It seems to us that the argument is that improvements in information technology caused a decline in the costs that firms face in producing goods. Falling prices have in turn encouraged a rapid take-up by consumers of products embodying information technology. Economists place costs on the supply side of markets, where firms produce and sell goods such as cars, oil, personal computers and Internet access. Take-up by consumers is on the demand side of the market. The quotation suggests that new information technology causes a decline in costs and hence in prices that enables large numbers of consumers to buy safer cars, personal computers and so on. Technological change, a supply-side phenomenon, is seen as a prime cause of economic change.

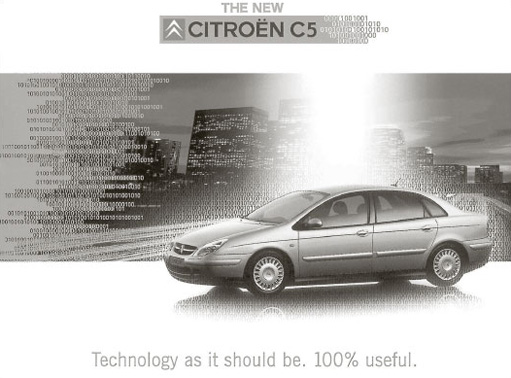

In D202_2, the author looked at the impact of newly introduced technologies in the early phase of the US auto industry and the PC industry, highlighting the similarities between what we are observing today in the IT-based industries and what we observed 100 years ago in an industry we now consider mature. As we write, technological change continues to be very rapid, and two particular technological developments will be used in this chapter to illustrate our discussion of the forces shaping the organisation of industrial production. The dilemma faced by car manufacturers in adjusting to the hydrogen economy’ of the future will be discussed in Section 4. We also discuss digital technology, which has revolutionised sound reproduction as well as the capture and transmission of visual images in DVD, digital television and digital cameras. Car manufacturers are also exploiting its potential. For example, the Citroën C5 ‘bristles with the latest digital technology to improve your motoring experience’ (see Figure 1). An advertisement for the C5 alludes to the origins of digital technology, showing instructions as sequences of ‘switches’ in a computer as being ‘on’ or ‘off’, or set to ‘1’ or ‘0’.

In this course we will introduce the use of economic models of markets, firms and industries to examine the relationships among consumer demand, technological change and costs. Section 2 develops the idea expressed in The Economist extract that falling prices were responsible for the rapid take-up of new products by consumers. This is an example of a widely observed relation between the quantity demanded of a good by consumers and the price of the good: the lower the price, the greater the quantity demanded. However, there are other influences on market demand. For example, consumers are likely to buy more goods if their incomes increase. So Section 2 explains how economists analyse the interaction between price and other influences. This analysis is the first part of the theory of consumer demand.

The rest of the course focuses mainly on the supply side of the market, exploring the role of costs and technological change in the organisation of production. The objective is to understand the process by which a firm – initially one among many similar firms jostling for position – emerges ahead of the pack to achieve an advantage over its competitors, as Ford did in the US automobile industry. What was so special about Ford? More generally, how can we account for the change in structure that so many industries seem to undergo? Why do most of the many small firms so common in the early years of new industries disappear to leave an established industry dominated by a few large firms? Why does the heterogeneity or extreme variety of those small firms in new industries give way to a much greater degree of similarity, indeed standardisation, among the few survivors?

In exploring these questions, economists use models of the relation between the output, technology and costs of firms. In Section 3, we define technology in an economic model of a firm, and use it to explore the link between technology and costs. We begin from a model in which firms take technology as given and their ability to change their costs is severely constrained, and then build in progressively more decision-making flexibility over the adoption and use of technology.

Section 4 links this analysis of technology and costs to the model of the industry ‘life cycle’ introduced in DD202_2. The life-cycle model represents an industry as if it were a biological organism going through the stages of birth, growth, maturity and decline, and is used to consider the interaction of demand and technology in shaping industrial structure. This section further extends the analysis of firms, technology and costs to include models where firms’ freedom to learn and create is one driver of technological change itself. This helps us to understand how a particular firm can become the ‘leader of the pack’ through innovation and how it can then gain an advantage over competitors by reducing its costs through large-scale production.