9.5 EMA techniques

In this section you will learn about the following EMA techniques:

- input/output analysis

- material flow accounting

- activity-based costing

- lifecycle costing.

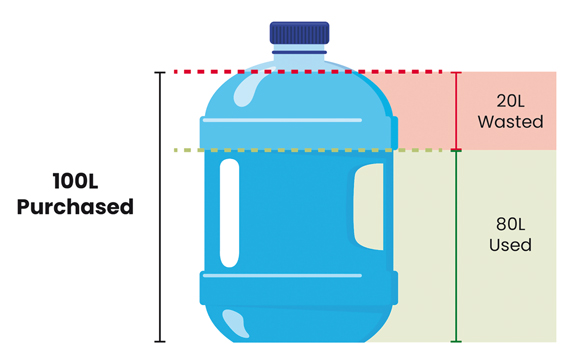

Input/output analysis is a technique used to reduce environmental resources and costs. Resources such as water, material and energy as inputs are balanced with the outputs such that what comes in must go out. For example, if 100 litres of water have been acquired but the production process only used 80 litres, then the 20-litre difference must be accounted for as this is considered avoidable waste for which actions need to be taken. The costs and resources used in the production process will become more transparent and hence manageable. Additionally, by incorporating both physical quantities and monetary values of outputs, businesses are compelled to prioritise environmental costs throughout their operations.

Another EMA technique is material flow accounting or flow cost accounting. This approach evaluates physical movement of materials in an organisation and offers transparency in material flows by examining the physical quantities involved, their costs and the value they bring. Flow cost accounting divides material flows into three categories: material, system, and delivery and disposal. The values and costs associated with each flow are calculated and analysed, enabling organisations to understand their impact on the environment and on their bottom line.

The ultimate goal of flow cost accounting is to reduce the quantity of materials used in an organisation, with the belief that not only will this have a positive impact on the environment, but also lead to cost savings in the long term. By tracking and evaluating the movement of materials and their associated costs, organisations can identify areas for improvement and make informed decisions to reduce waste and optimise their operations.

Walz and Guenther (2021) analysed 73 case studies about material flow accounting and reported that tracking and evaluating material flow can contribute to improved performance and cost reduction for companies, while also helping to reduce environmental damage. The authors also provide some challenges and drawbacks associated with the implementation and application of material flow accounting within these companies.

If you are interested in studying further on the topic, Walz and Guenther’s 2021 article ‘What effects does material flow cost accounting have for companies?: Evidence from a case studies analysis’, which appeared in the Journal of Industrial Ecology, can provide valuable insights and evidence regarding the impact of material flow cost accounting on companies.

Activity-based costing (ABC) is another cost allocation method that assigns internal costs to cost centres and drivers based on the activities that generate those costs. In an environmental accounting context, ABC helps distinguish between environment-related costs, which can be attributed to joint cost centres; and environment-driven costs, which are often hidden within general overheads.

Lifecycle costing (LCC) is another technique used in environmental accounting that takes into account the full environmental impact and costs associated with producing a product from start to finish, often referred to as ‘cradle to grave’. This technique aims to identify all the environmental costs associated with a product, including raw material extraction, manufacturing, transportation, usage, disposal and so forth. LCC allows businesses to identify the full impact of their products and processes on the environment, including those that may have been previously overlooked.