1 Cost classification

An important role of management accounting in most organisations is providing managers with information about the cost of making each particular product or, in the case of a service organisation, providing each particular service. Managers need product cost information for a number of reasons, including:

- establishing selling prices

- determining product (or service) profitability

- cost management

- valuing inventory for financial accounting purposes.

This need for cost information raises the fundamental question: what constitutes a cost?

Costs can be defined as the expenses incurred by a company in order to purchase goods, produce products, provide services, pay staff or perform repairs. These expenses are quantifiable in monetary terms. However, there are also costs that cannot be measured monetarily, known as external costs or externalities. Externalities refer to the impact a company has on parties outside the organisation that did not participate or agree to the activities causing the impact. For instance, the construction of a big manufacturing unit may cause displacement of the local community. The people affected by the displacement are not the buyers or sellers of the manufacturing unit’s services or products, but the impact on their lives cannot be measured monetarily. The construction of this unit may also contribute to the depletion of the natural resources and biodiversity within the region – these are also examples of externalities. While externalities such as these are significant, management accountants have historically concentrated on costs that can be quantified. However, with increasing attention on the need for companies to be more socially and environmentally responsible, the focus of management accounting is changing.

Knowing the cost of a product is essential for any business. It helps to ensure that the price covers all the expenses associated with producing and selling the product, while also generating a profit. Having accurate cost information can also help in making informed business decisions, such as identifying areas for cost savings, setting the right price, improving efficiency and increasing profitability. This course defines ‘product’ in a broad sense and can refer to both tangible goods and services.

Costs can be classified in several ways. The principal classifications are:

- variable and fixed

- direct and indirect.

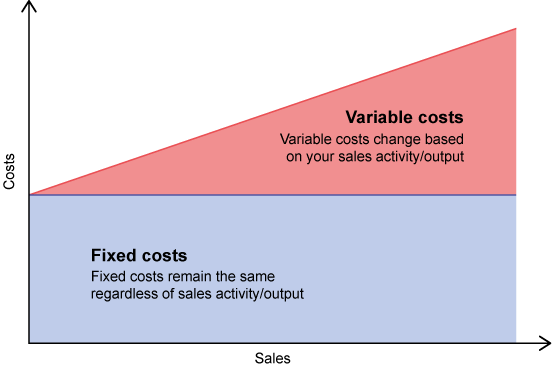

The classification into variable costs and fixed costs is used in marginal costing (a costing approach in which variable costs are charged to product units and fixed costs are charged against profit as a period expense – that is, not charged to specific units of output or activity). Figure 2 shows the difference between fixed and variable costs.

The classification into direct costs and indirect costs is used in absorption costing (a costing approach that charges both direct costs and indirect costs – and, crucially, fixed and variable costs – to units of output or activity).

There are other ways of classifying costs, such as distinguishing between actual cost and standard cost or controllable cost and non-controllable cost. These classifications are relevant in standard costing and budgetary control.