4.1 Direct/indirect and fixed/variable costs

You will remember that fixed costs and variable costs were discussed in Section 1 and that this distinction was crucial to understanding cost behaviour. You should note that costs may be simultaneously:

- direct and variable

- direct and fixed

- indirect and variable

- indirect and fixed.

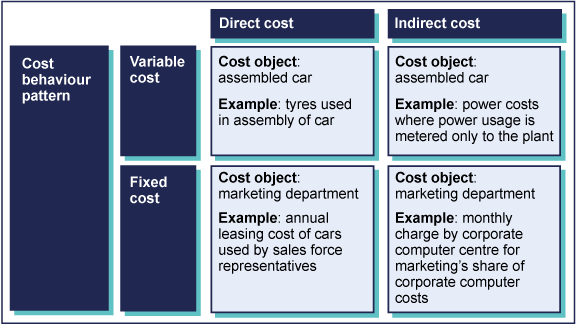

An extended example of cost classification is given in Figure 10.

In Figure 10, you can see that the tyres used in the assembly of a car are both variable and direct costs. Another example of a direct cost is the annual leasing cost of cars used by sales representatives, although you should note that these particular costs are fixed as they do not vary with the level of activity in terms of the number of cars assembled.

In terms of indirect costs, you can see that power costs, where usage is metered at the plant level only, constitute indirect but variable costs. Finally, the monthly charge by the corporate computer centre for marketing’s share of corporate computer costs will be classified as simultaneously indirect and fixed because, again, these will not vary with the level of activity in terms of cars produced.

For a meaningful system of cost control to work, there must be a proper administrative system operating that enables costs to be monitored and allocated in order to calculate the cost of the product or service in an appropriate way.

The cost of each unit in a commercial organisation is then related to the sales revenue generated by selling each unit. In other words, once the cost of each unit is known, you can calculate the profit per unit sold. Alternatively, you can set the selling price at a level that will generate the profit per unit that you wish to achieve.