2 Planned and actual values

Notation in equations

In the sections which follow, you will be introduced to some simple equations. Don’t panic! Wherever they are used, we teach you step by step how to read them. A general point to be aware of is that where one term is multiplied by another we will follow standard maths notation and leave out the multiplication sign. For example, in Section 6, you will see the equation of consumption C = a + bY. We write ‘bY’ instead of writing ‘b × Y’ (with the multiplication sign ‘×’). The general rule is that when two terms are placed side by side, they are to be multiplied.

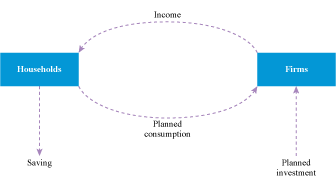

The economy as modelled by the circular flow diagram, below, appears to be a rather peaceful place, where expenditure is always identical to output and saving is always identical to investment. But saving decisions and investment decisions are made by different people, so it seems there is no reason why they should match, and Keynes’s model of change in national income depends precisely on expenditure being too great or too small to match output and hence on saving being too small or too great to match investment.

Activity 2

Watch the video below to see how this paradox is resolved. This video is part of the Open University course DD209, Running the economy, so there will be references to Block 1 of the course, which you should ignore.