Government Demand in the UNI-CGE Model (15 minute read)

Learning Outcome:

At the end of this lesson, you will understand and be able to explain government demand behavior in the UNI-CGE model.

Government Accounts in the US 333 SAM

Figure 1 presents the US333 SAM. Government income is reported in the SAM's government row account and its expenditures are reported in the SAM's government column account (both accounts are shaded in green).

Figure 1. Government accounts in the US 333 SAM

Large type version of Figure 1 available HERE.

The U.S. government's row account reports that its income is sourced entirely from tax revenues, paid from the tax column accounts. These revenues total $$2,294 billion. The government's column account reports that the US government spends its tax revenues entirely on service commodities, with no purchases of agricultural or manufactured commodities. Its total spending on commodities is $2,258 - less than its tax revenue.

The difference between the US government's income and and expenditure is its fiscal balance (surplus or deficit). The US government has a budget surplus of $35 billion (with rounding). This surplus adds to the supply of US savings, and is reported as a payment from the government to the savings-investment row.

Government Demands Fixed Quantity Shares of Commodities

Government in the UNI-CGE model is assumed to have a simple demand function: the quantity shares of each commodity in its consumption basket always remain the same.

Consider an example in which the government's tax revenue is $100 and the government purchases just two goods: paper and pencils. Both paper and pencils cost $1 per unit. Initially, the government purchases 100 items - 60 pads of paper and 40 pencils - for $100. The quantity shares of paper and pencils in the government's initial basket are therefore 60 percent and 40 percent, respectively.

What happens if tax revenue or the prices of paper and pencils change? It depends on the government closure that you choose. (Learn more about government closure in the lesson on macro closure in the Macro and GE module.)

Closure 1: Government Can Run Deficits and Surpluses

In this closure, the government always purchases the same quantities of commodities. It can run budgets surpluses or deficits if the cost of its purchases is greater or less than its tax revenue.

What if the government's tax revenue increases by 10% to $110, with no change in paper or pencil prices? Quantities of both goods in the government's basket will remain the same (a 60/40 split), and cost the same ($100), so the government will now run a surplus of $10.

What if the price of paper doubles to $2, with no change in government tax revenue? The government will continue to buy 60 pads of paper and 40 pencils but the total cost of its basket will increase to $160. With tax revenue the same, the government will now run a $60 deficit to cover the added cost of its purchases.

Closure 2: Government Deficit/Surplus is Fixed

In this closure, the government is assumed to be unable to run fiscal deficits or surpluses. Instead, its spending must adjust to any changes in tax revenue or prices.

If tax revenues go up 10%, with no change in prices, the government's spending will also go up 10%. It will buy 10% more of both paper and pencil quantities, maintaining the 60/40 quantity shares. It will now spend $66 on paper, and $44 on pencils - equal to its new budget of $110.

If the price of paper doubles to $2, with no change in tax revenues or pencil prices, the government will have to reduce its spending. Even though paper has become more expensive relative to pencils, the government will continue to buy the same quantity shares of 60/40 for paper and pencils. It will reduce the quantities of both items that it purchases by the same proportion - 37.5% - so its expenditure matches its tax revenue of $100.

Government Demand Equations in the UNI-CGE Model

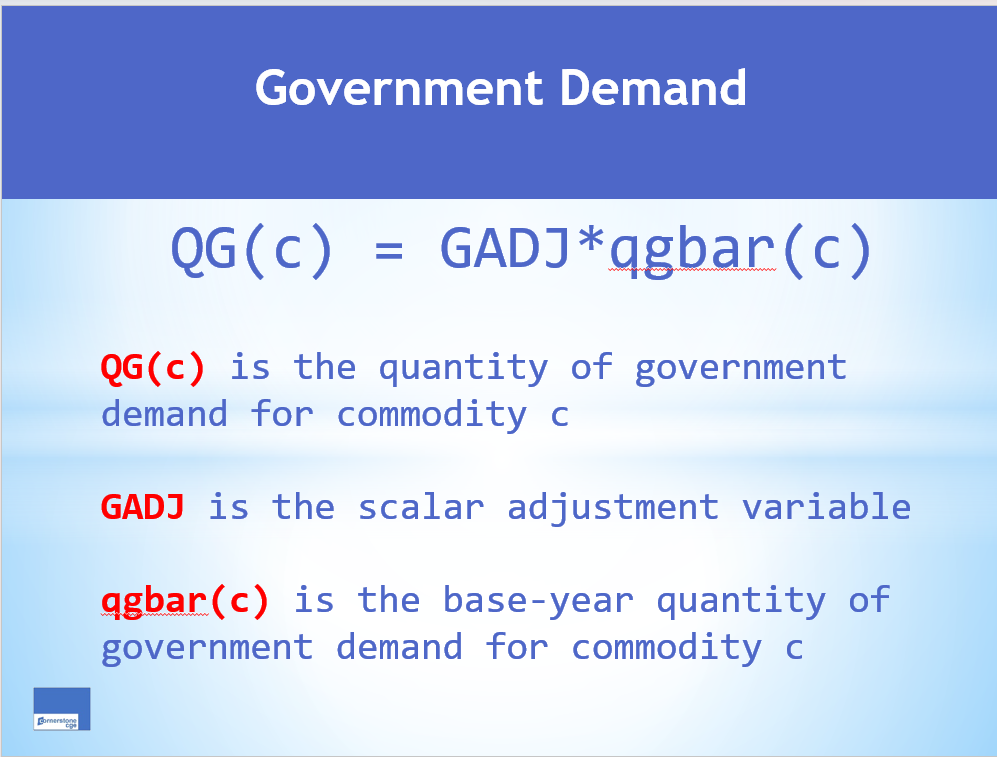

The government demand equation in the UNI-CGE model is presented in Figure 2. The quantity of government demand for commodity c (QGc) is the product of a scalar - the exogenous variable GADJ, and the initial quantity of demand for each commodity (qgbarc). The variable GADJ is given an initial value of one.

Figure 2. Government demand function in the UNI-CGE model

Choice of Government Closure

If you have chosen closure 1, the value of variable GADJ remains fixed at 1, which means that the government will always buy the same quantities, QG, of each commodity C. If its tax revenue changes, or the prices of commodities change, then the deficit or surplus (variable GSAV, not shown in this equation) must adjust to accommodate the cost of the unchanged quantities in its basket.

If you have chosen closure 2, then you will allow the value of GADJ to vary, and fix the government surplus or deficit at its initial level. Variable GADJ is a scalar that will change the quantities purchased of all goods by the same proportion. If tax revenues or commodity prices change, then GADJ will adjust the quantities of all commodities by the same proportion until total expenditures equal government revenue.

Government Income and Spending Equations in the UNI-CGE Model

Now that the quantities of commodities demanded by the government demand have been defined, Equation 1 in Figure 3 calculates the total expenditure (EG) on the basket. It is the sum of quantities (QG) of commodity C multiplied by their prices (PQ).

Figure 3. Government Income and Spending

Variable YG in equation 2 in Figure 3 is total government revenue from taxes. Now that we know the value of government expenditure on commodities, we can calculate the difference between government revenue and its expenditures on commodities, GSAV. This variable is the government surplus or deficit.