Macro Closure (35 minute read)

Learning Outcome

After completing this lesson, you will understand the role of macro closure decisions in a CGE model and the options for macro closures in the UNI-CGE model.

What Is Macro Closure

A CGE model experiment disturbs an economy's equilibrium. The model searches for a solution by adjusting prices and quantities until equilibrium is reestablished - income is again equal to expenditure for all agents, and macro balances such as Savings = Investment are restored.

What ensures that the macro variables are in a new equilibrium? In the lesson on macro balances, you learned that a CGE model includes equations that constrain macro relationships to be in balance. To achieve this, some macro variables must be given roles as adjustment mechanisms. Macro closure is the decision by the modeler about which macro variables will adjust to reestablish an equilibrium following a model shock.

Why One Variable Must be Allowed to Adjust

The intuition is this: Consider a model equation that constrains the sum of savings by households (HSAV) and government (GSAV) to be equal to total investment (I).

HSAV + GSAV = I

What if the modeler fixes household and government savings at their initial levels and total investment is also fixed? If the model is shocked by an experiment, it cannot adjust savings or investment as it tries to find a new equilibrium. That is, the model is over-determined. For the model to find a solution, one variable in the equation must be allowed to adjust.

Why Choice of Macro Closures is Important

The choice of macro closures is an important step in developing your model and research project because different closures can lead to very different model results. Let's consider the government balance equation in the UNI-CGE model as an example:

YG = EG + GSAV

where YG is government revenue, EG is total government spending on goods and services, and GSAV is the fiscal surplus or deficit. If government revenue changes, the closure decision describes which variable, government spending (EG) or government savings (GSAV), is fixed and which of the two will adjust to adjust to maintain the balance.

Consider the example of a tax increase that raises YG. The closure decision determines whether the government (1) continues to spend the same amount, allowing the government surplus to grow, or its deficit to shrink, or (2) uses the new revenue to increase its spending and maintain the initial budget surplus or deficit. Experiment results for the budget deficit will be very different in the two cases. The government closure decision will therefore be an important part of planning a study such as a government tax policy review.

Your choice of a closure rule should reflect the circumstances and the policies in the economy under study. It is a good practice to review the macro closures in your model, and to include a description of your closure decisions in your analysis.

Flagging Closure Choices in the UNI-CGE Model

In this lesson, we explain three macro closure decisions and how they are presented in the UNI-CGE model:

- Savings-investment closure

- Government closure

- Foreign savings closure

The choice of closure in the model is made using FLAGS. For each closure, you have two to three options that describe which macro variable is fixed and which adjusts. Each option has a flag number. You select the flag that corresponds to the closure that best describes the economy or the research problem that you are studying.

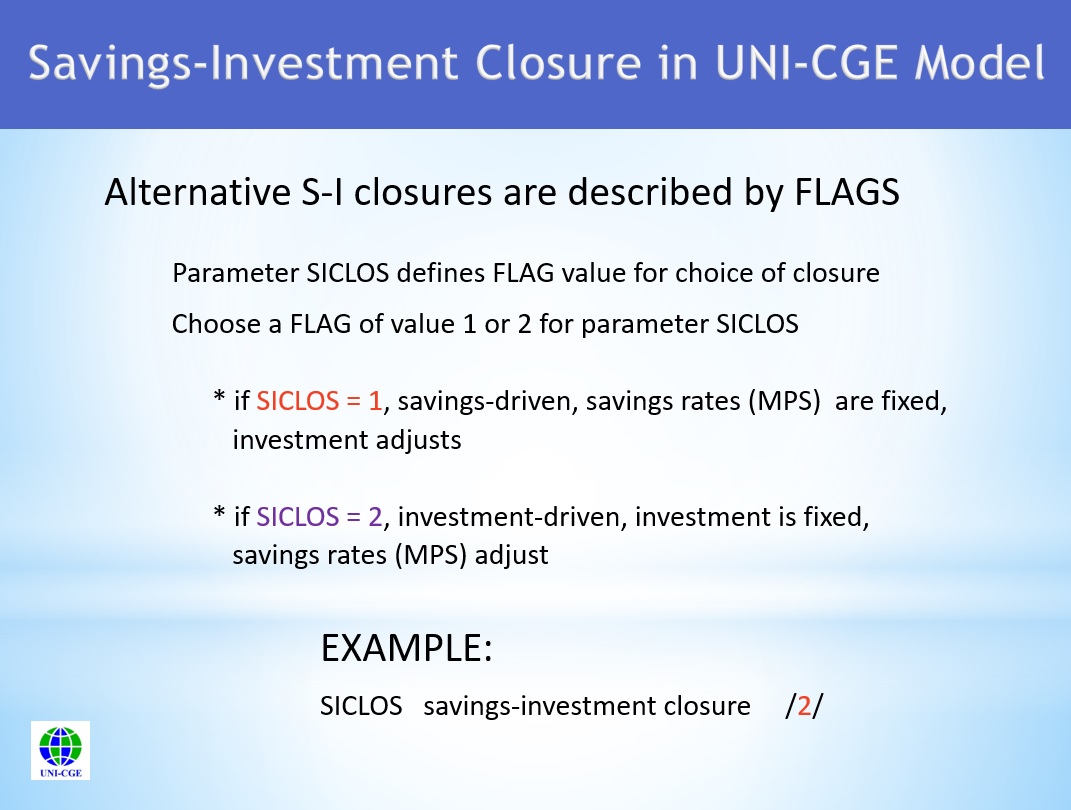

Savings-Investment Closure

The savings-investment closure decision defines which one of the two variables - investment or savings - is fixed, and which will vary to ensure that investment and savings are equal. There are two types of savings-investment closures:

- Savings-driven (also called neo-classical)

Households' MPS is the percentage of their savings out of after-tax income. MPS is fixed in this closure, but the supply of savings can still vary if household income or tax rates change. A change in the supply of savings causes an accompanying change in the quantities of goods demanded by investors .

- Investment-driven (also called Johansen)

Quantities of investment spending are fixed but if the prices of investment goods change, or if investment quantities are changed as an experiment, then the value of investment spending will also change. Households' marginal propensity to save (MPS) will adjust until the supply of savings is equal to the new level of investment spending.

Figure 1. Savings-investment Closure

Larger version available HERE.

Many CGE models, including the UNI-CGE model, adopt the investment-driven approach. This closure is widely used because it provides a simple and transparent description of investment spending. CGE models do not account for financial variables, like interest rates, or future expectations that help determine investment decisions, so fixing investment quantities is a neutral assumption that implies that investors will continue their current purchasing behavior.

The savings-driven approach may be more appropriate in some circumstances. For example, the research may address the outcome of the fall in consumer confidence during the Covid pandemic, which led to higher household savings rates.

Government Closure

Government income and spending become imbalanced if there is a change in government revenue, or if the prices or quantities of the goods consumed by the government change. There are three government closure options in the UNI-CGE model for restoring equilibrium:

- Accommodating government budget surplus or deficit

In the first option, government purchases are fixed at their initial quantities. Government spending will change if the prices of the goods change, and government revenue will change if there are changes in tax payments. The fiscal surplus or deficit will adjust to accommodate any changes in the values of government spending or tax revenues. This closure is appropriate for countries that have the flexibility to run deficits and surpluses, or if the research question is the effect of an experiment on the government's budget balance.

- Fixed government budget surplus or deficit

The second option fixes the government's budget balance at the initial level. It requires the government to adjust the quantities that it purchases if there is a change in government income, or if there is a change in the prices of the commodities it demands. This closure is appropriate for countries without the ability to run surpluses and deficits, or if there is a balanced budget constraint imposed by policy-makers.

- Tax replacement

The third option describes how a change in tax revenue is distributed in the economy. Instead of allowing the revenue to affect government savings or spending, the government rebates any new tax revenue back to households. This is a "tax replacement" closure. It allows the modeler to explore situations such as a new tax on plastic grocery bags, in which the government returns the new revenue to households as an income tax cut (or an income tax increase in the case of a different tax cut). Tax replacement leaves households with as much income as before, but with price signals that influence their decisions about what to buy.

Parameter GOVCLOS (government closure) is defined with a flag value of 1, 2 or 3 (Figure 2). If the government surplus/deficit is allowed to accommodate changes in government income or spending, set the flag to a value of 1. If the budget balance is fixed, and government purchase quantities must adjust when tax revenue or prices change, set the flag to a value of 2. If changes in tax revenue are distributed back to households, set the flag to a value of 3.

Figure 2. Government Closure

Larger version available HERE.

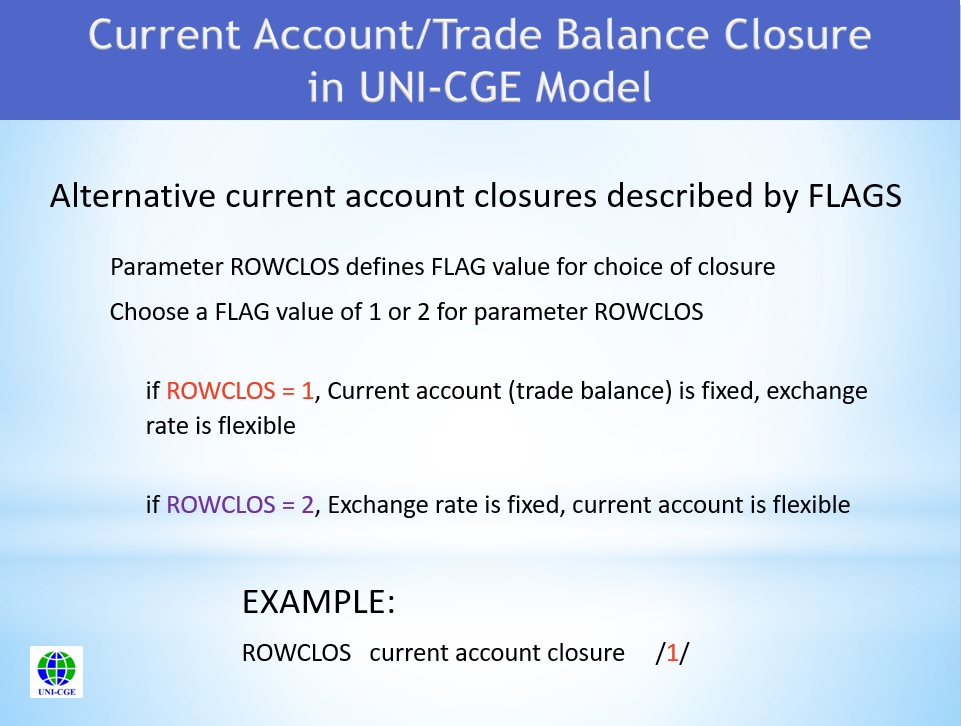

Current Account/Trade Balance Closure

The current account, or balance of trade, is the flip side of the capital account, which is the inflow or outflow of foreign savings that finance trade deficits or surpluses. Fixing or flexing foreign capital flows in this closure is equivalent to fixing or flexing the trade balance. That is why this closure is often referred to as the trade balance closure.

The capital account balance is achieved by flexing or fixed the exchange rate, and flexing or fixing the trade balance. One is fixed and the other is allowed to be flexible.

In the UNI-CGE model, the exchange rate (EXR) is expressed as domestic current/foreign currency. When the exchange rate depreciates, the change in EXR is positive because more units of domestic currency are required in exchange for one unit of foreign currency. An exchange rate appreciation is a negative change, since fewer units of domestic currency can now be exchanged per unit of foreign currency.

The current account closure has two options:

- Fixed trade balance, flexible exchange rate

The first option is to fix the trade balance and allow the exchange rate to adjust to maintain it. With this option, if pressure builds to run a trade deficit, and import more goods relative to exports, the exchange rate will depreciate. This adjustment will make imports more expensive and exports more competitive, until the initial balance of trade and level of capital flows is restored. And vice versa, the exchange rate will appreciate if there is pressure to run a trade surplus.

- Flexible trade balance, fixed exchange rate

The second closure option is to fix the exchange rate and allow the trade balance to adjust. This closure is relevant when a country has a fixed exchange rate regime or when the research question examines the effects of a devaluation or deterioration in the exchange rate.

Parameter ROWCLOS is defined with a flag value of 1 or 2 (Figure 3). If you choose a fixed trade balance with a variable exchange rate, set the flag to a value of 1. If you choose a fixed exchange rate regime and a flexible trade balance, set the flag to a value of 2.

A fixed trade balance closure is widely used in CGE models. One reason is that CGE models do not include financial markets or monetary policy, which have major influences on foreign capital flows. Therefore, a neutral approach is to fix foreign savings at the initial level. A second reason is because static, single-period CGE models, like the UNI-CGE model, describe foreign capital inflows as beneficial to an economy, but they do not account for the burden of repaying them in the future.

Figure 3. Current Account/Trade Balance Closure

Larger version available HERE.

Default Macro Closures in the UNI-CGE Model

| Closure | Flag | Description |

|---|---|---|

| Savings-investment | 1 | Savings-driven (neo-classical) |

| Government Budget | 2 | Fixed government surplus/deficit |

| Foreign savings | 1 | Fixed trade balance/flexible exchange rate |

CHECK YOUR UNDERSTANDING

Copyright Cornerstone CGE CC 4.0 BY-NC-SA