What Are General Equilibrium Effects? (20 minute read)

You will learn that general equilibrium effects include both the direct effects on the activity, commodity or agent that is shocked, and the indirect effects on the rest of the economy; and how a structure table and SAM can be used to identify key general equilibrium effects.

The Economy Is Shocked

There are many ways that an economy can be shocked. In recent years, CGE modelers have explored problems including the effect of the covid pandemic on the supply of workers, spikes in energy prices caused by war, and the effects of drought and wildfires on the supply of some food commodities. General equilibrium models have made important contributions to our understanding of how shocks such as these affect not only the industries or agents that face immediate disruption, but also all the other parts of the economy to which they are connected. CGE models are able to quantify the economy-wide effects of the shocks because they describe an economy as a whole, and the flows of income and spending that connect its parts.

General Equilibrium Effects: Direct + Indirect Effects

Economic shocks have direct effects on the affected activity, commodity or agent. For example, a labor strike in the auto industry directly affects auto producers, likely causing their production levels to fall and the price of autos to rise. But the strike is also likely to have wider effects on the economy. Industries that produce auto parts and companies that sell used cars are also likely to be affected. Striking workers who are losing pay are likely to spend less on restaurants and other services, creating ripple effects on those industries. And, the demand for imported cars and the supply of auto exports could change, too, with effects on the balance of trade and the exchange rate. All of these effects, outside of the auto industry, are the indirect effects of a shock. Direct and indirect effects together are the general equilibrium impacts of a shock.

Identifying Linkages in the Economy

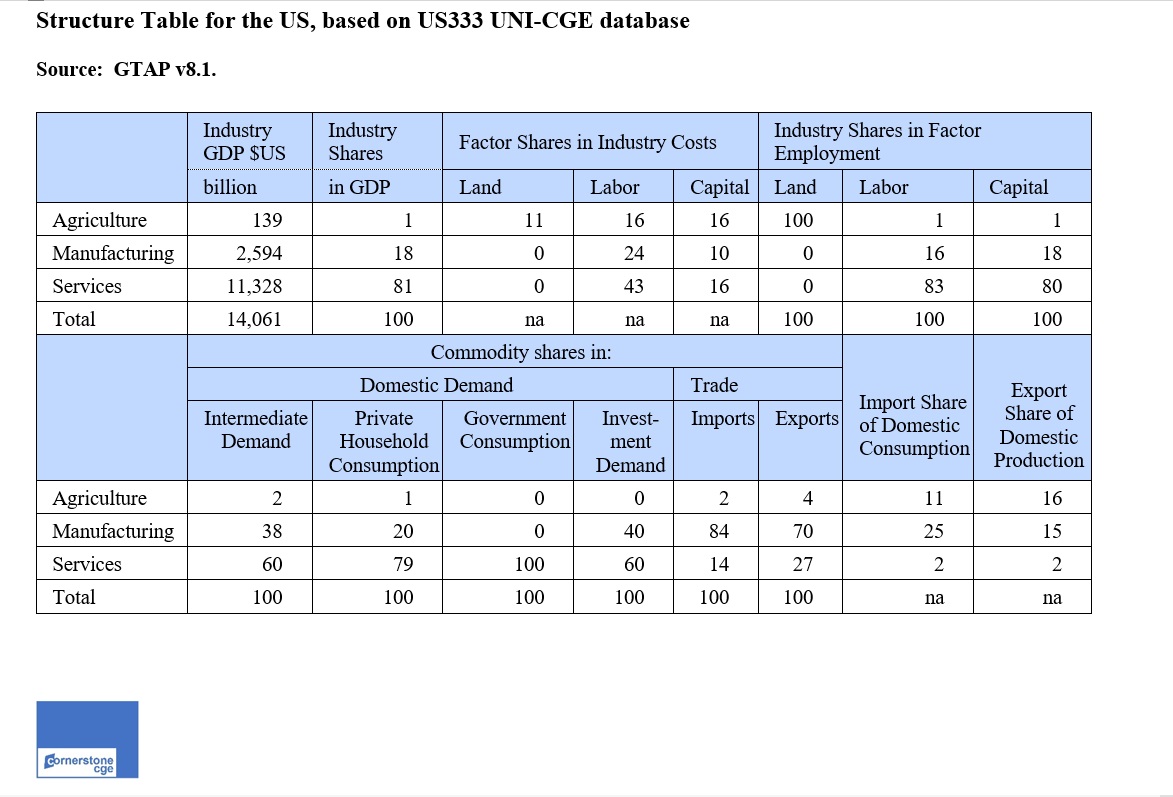

With so many economy-wide impacts, how can you begin to organize your thinking about the general equilibrium effects of a shock? Two tools are the structure table and the SAM. You can use review their data to identify the strongest linkages between the element that is shocked and the rest of the economy.

For example, in the US333 structure table (Table 1), services is the largest employer in the economy. You might therefore expect that a decrease in its demand for labor will have a large negative wage impact, with significant economy-wide effects such as increased hiring by other production activities, and lower household income and spending. If you begin your interpretation of results by first examining country data to identify key linkages, you can focus your analysis on what are likely to be the key model results.

Larger version available HERE.

An Example - A Labor Productivity Shock

As an example, let's assume that the modeler is using a CGE model with the US333 database, and has defined a shock that decreases labor productivity in MFG. This shock effectively raises labor costs in MFG because more workers are needed to produce the same quantity of output. The US333 structure table can help to identify the strongest linkages between MFG and the rest of the economy, pointing us to the potentially key effects of the shock.

Direct effects will occur in US MFG. From the structure table, we know that labor accounts for 25% of production costs in MFG, so its increased labor costs will likely lead to a significant increase in the sales price of MFG and, depending on the demand response by domestic and foreign consumers, a fall in MFG output. Imports of MFG account for 25% of US MFG consumption, so a reduction in domestic supply will probably lead to increased MFG imports. Exports account for 15% of MFG output, and their supply will fall. The MFG trade balance will therefore tend toward a deficit, if imports rise and exports fall.

Input-Output Linkages - The structure table reports that MFG commodities account for almost 40% of the intermediate inputs used by US production activities. This suggests that changes in MFG output will have potentially important impacts other activities due to their input-output linkages.

You can learn more about these linkages by examining the input-output (I-O) matrix in the SAM, shown in the intersection of the activity columns and commodity rows (Table 2). MFG has the largest cost shares in intermediate demand by the downstream AGR activity and is an important input into SER. Because of these I-O links, input costs and output of AGR and SER are likely to be affected by the labor shock, even though it affects only the MFG activity.

You may notice that the MFG activity is reliant on MFG inputs. This intensive own-use is common in SAM databases. It results from the aggregation of data in the country database.

Larger version available HERE.

Trade and Macro Impacts - MFG goods account for 84% of total US imports, and 70% of total exports. Because MFG is the main export and import of the US, the pressure this creates toward a growing trade deficit is likely to have to significant macro effects on the exchange rate or the trade balance, depending on the trade balance macro closure. If the trade balance is fixed, the exchange rate will depreciate, dampening MFG imports and stimulating exports of AGR and MFG. If the exchange rate is fixed, foreign capital inflows will likely increase, affecting the level of investment spending or household savings, depending on the investment-savings macro closure.

Household Demand - MFG accounts for only 20% of household spending, as reported in the structure table. If the supply of the MFG commodity falls and its price rises, households will adjust their consumption baskets based on their preferences. They may consume less MFG and more AGR and SER.

Government tax revenue - Based on the SAM, MFG is the largest source of tax revenues from sales, import and export taxes. MFG production and export tax revenues are likely to fall due to lower domestic production levels and a reduced export supply, but import tariff revenue could increase if consumers replace domestic MFG with imported varieties. The net change in total US tax revenue is hard to predict because supply, demand and trade in other commodities, and their related tax payments, will also change due to the MFG shock. The CGE model takes into account all taxes in the US economy as it computes the net effect on government revenue and the fiscal surplus or deficit.

A Road Map for Analyzing Results

A CGE model experiment generates many results because the economy as a whole adjusts to a shock. Organizing and understanding general equilibrium results is challenging, especially when you are starting to build your modeling skills. Before examining results, you can use the structure table, and the SAM, to identify the key relationships in the circular flow of income and spending in the country under study.

CHECK YOUR UNDERSTANDING

Copyright Cornerstone CGE CC 4.0 BY-NC-SA